Wealth Management

Planning

Significant wealth creates unique complexities. Navigating financial strategies involves addressing unexpected challenges that arise from both personal changes as well as the ever-evolving investment and tax landscape.

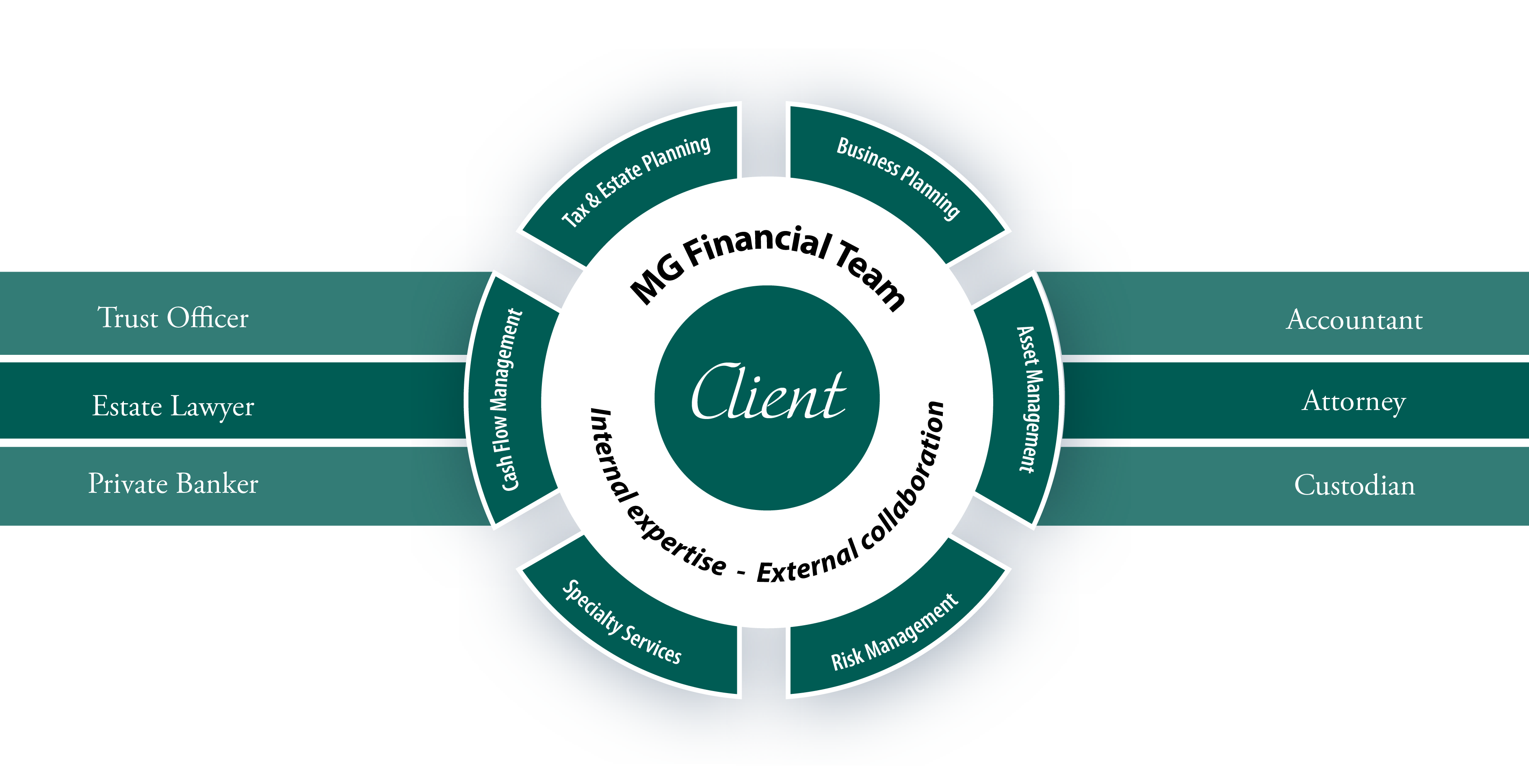

MG Financial works to streamline the wealth management process, provide safeguards while proactively seeking investment opportunities to meet current and future financial needs. Our focus on a select clientele allows us the time and availability to address the many facets of significant wealth and adjusting any component, as needed, on an ongoing basis.

Our multifaceted approach includes developing a comprehensive financial strategy that guides you to the future. We draw on our knowledge and experience and coordinate with other professionals when appropriate to provide you with a tailored plan. This plan serves as a roadmap and includes asset allocation, investment manager selection, income and estate tax planning, cash flow management, internal tax projections and analysis, risk management, corporate compliance, trust services, estate settlement, family governance, philanthropic objectives and other specialty wealth services.

Your customized Wealth Roadmap ensures your strategies remain cohesive and work together in the coordination of your financial life.

A Wealth Roadmap allows us to create and modify various long-term and client-specific scenarios. Understanding the potential impact of different economic environments and personal options leads to making better decisions. Roadmaps allow us to be more strategic and guide you to the best approach with a sound understanding of possible solutions.

Asset Management

At MG Financial, portfolio management includes asset allocation executed through our disciplined manager research and selection process. We build tailored and durable portfolios using a strategic asset allocation based on your specific investment objectives and risk parameters and implement the strategy using a multi-manager approach.

Manager Research and Selection Process

Philosophy

We favor an investment approach that maintains fundamental analysis as a core component of the manager's strategy.

Performance

Managers must provide consistent added value and strong risk/return characteristics over multiple market cycles.

Process

We seek clearly defined investment policy and an investment process that remains consistent with stated objectives.

People

We focus on established organizational structures with strong leadership teams that work to cultivate a culture of teamwork.

MG Financial identifies proven managers across a variety of financial market sectors and investment disciplines with solid management teams. With over 35 years of experience, we tend to favor managers who use a fundamental, bottom-up research, rather than market timers or black box approaches.

Our goal is to select managers that offer consistent added value and improve the portfolio's risk/return characteristics. We always take a fee and tax sensitive approach to portfolio construction.

To maximize the effectiveness of each portfolio, we continuously monitor our network of investment managers. This work helps to shape our process and identify the best investment opportunities for you.